In a bustling metropolis like Dubai, known for its ever-growing business landscape, the intricacies of corporate taxation can often become overwhelming for business owners. Dubai’s tax-friendly policies have been a significant pull factor for international investors; however, understanding the local tax regulations remains crucial for business sustenance. This is where the role of a corporate tax consultant in Dubai comes into play.

Why Are Tax Consultants Essential in Dubai?

International Business Operations:

For companies operating on an international scale, the tax implications become multifaceted. Tax consultants in Dubai are adept at understanding double taxation treaties, international tax implications, and potential tax-saving strategies.

Changing Regulations:

The tax landscape isn’t static. With new regulations, amendments, and interpretations emerging, businesses must remain updated to avoid potential pitfalls. Tax consultants provide businesses with timely updates and strategies to adapt to these changes.

The Tax Landscape in Dubai

Dubai, part of the United Arab Emirates (UAE), is renowned for its low-tax environment, providing a haven for corporations to grow and flourish. Although there is no federal income tax, corporations dealing with oil and foreign banks have specialized tax regulations. Moreover, the introduction of Value Added Tax (VAT) at 5% in 2018 changed the taxation landscape significantly. This adds layers of complexity, especially for new entrants into the market or those who are less familiar with the legal tax obligations in the UAE.

What Do Corporate Tax Consultant in Dubai Do?

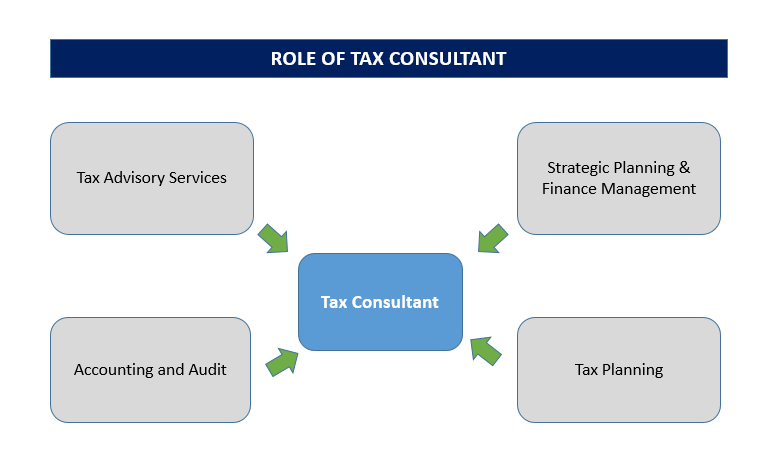

Corporate tax consultants in Dubai specialize in understanding both local and international tax laws, offering services that range from tax planning and compliance to risk mitigation and representation in tax-related disputes. Here are some of the crucial functions they serve:

Tax Planning

Tax consultants help corporations identify tax-saving opportunities within the legal framework, which can be particularly beneficial for companies with multiple revenue streams or international operations.

Regulatory Compliance

With changing tax laws and regulations, maintaining compliance is more challenging than ever. Corporate tax consultants in Dubai help businesses adhere to local, federal, and international tax obligations.

Risk Mitigation

Through regular audits and reviews, consultants can identify potential risk areas, providing recommendations to avoid hefty penalties.

Representation

In case of tax disputes, a seasoned tax consultant in Dubai can represent your corporation in legal matters, ensuring the best possible outcomes.

The Multifaceted Role of a Corporate Tax Consultant in Dubai

Advisory Services: Tax consultants don’t just focus on compliance. They provide actionable insights and strategies for effective tax planning, ensuring businesses can make informed decisions.

Due Diligence and Compliance: Whether it’s for a merger, acquisition, or merely a routine audit, tax consultants ensure that the books are in order, minimizing risks of penalties or potential legal actions.

Representation: In case of disputes or clarifications with tax authorities, having a seasoned tax consultant by your side can be invaluable. They can represent the company, negotiate terms, and provide clarity on complex issues.

Education and Training: As regulations evolve, it’s essential for businesses to ensure their teams are updated. Tax consultants often conduct workshops and training sessions for corporate teams, ensuring they remain in the loop.

The Cost-Benefit Analysis

Although hiring a corporate tax consultant in Dubai is an additional cost, the financial benefits they offer in the long run far outweigh the initial investment. From ensuring that you take advantage of all available tax incentives to preventing potential penalties from non-compliance, a tax consultant can save your corporation a substantial sum in the long run.

Why Your Business Needs One

Navigating the labyrinth of tax laws, while focusing on core business functions, can be taxing (pun intended). A corporate tax consultant can serve as your navigator, ensuring that you benefit from the favorable tax climate while remaining compliant with the laws.

Choosing the Right Tax Consultant in Dubai

With several consultancy firms vying for attention, it’s essential to choose one that aligns with your business needs. Factors such as experience in your industry, the scale of operations, reputation, and client testimonials can guide this decision.

As Dubai continues its trajectory as a global business powerhouse, the role of tax consultants becomes ever more crucial. They are the unsung heroes behind the scenes, ensuring that businesses not only stay compliant but also leverage tax strategies to their advantage. As the adage goes, “It’s not about how much you make, but how much you keep.” In the intricate dance of corporate taxation in Dubai, having a seasoned tax consultant ensures your business keeps its rightful share.

Dubai’s competitive business environment and tax-friendly policies make it an attractive destination for global corporations. However, the nuances of tax regulations can pose significant challenges. A corporate tax consultant can be your company’s financial guardian angel, helping you steer clear of potential pitfalls while optimizing your tax position. In an ecosystem as competitive as Dubai’s, this specialized guidance can make all the difference.